Annual rate of return formula

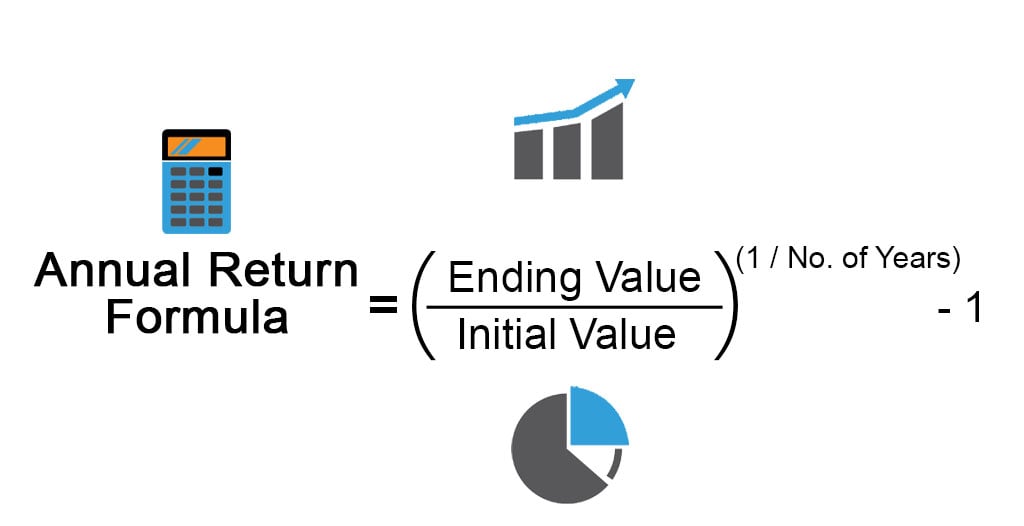

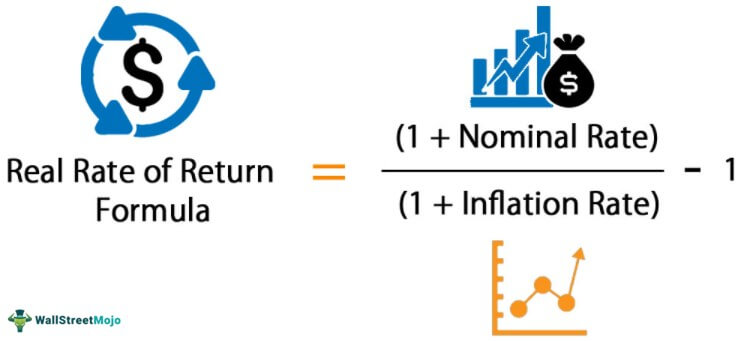

The compound annual growth rate CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year. The real rate of return is the actual annual rate of return after taking into consideration the factors that affect the rate like inflation and it is calculated by one plus nominal rate divided by one plus inflation rate minus one and inflation rate can be taken from consumer price index or GDP deflator.

Rate Of Return Definition Formula How To Calculate

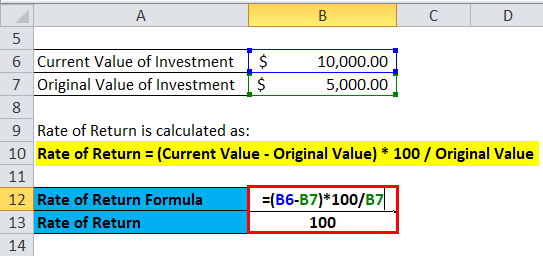

The formula in D5 is.

. Rate of Return. Formula to Calculate Effective Annual Rate EAR The formula of Effective Annual Rate Effective Annual Rate Effective annual rate EAR is the rate actually earned on investment or paid on the loan after compounding over a given period of time and is used to compare financial products with different compounding periods ie. It is the rate of return on a real estate.

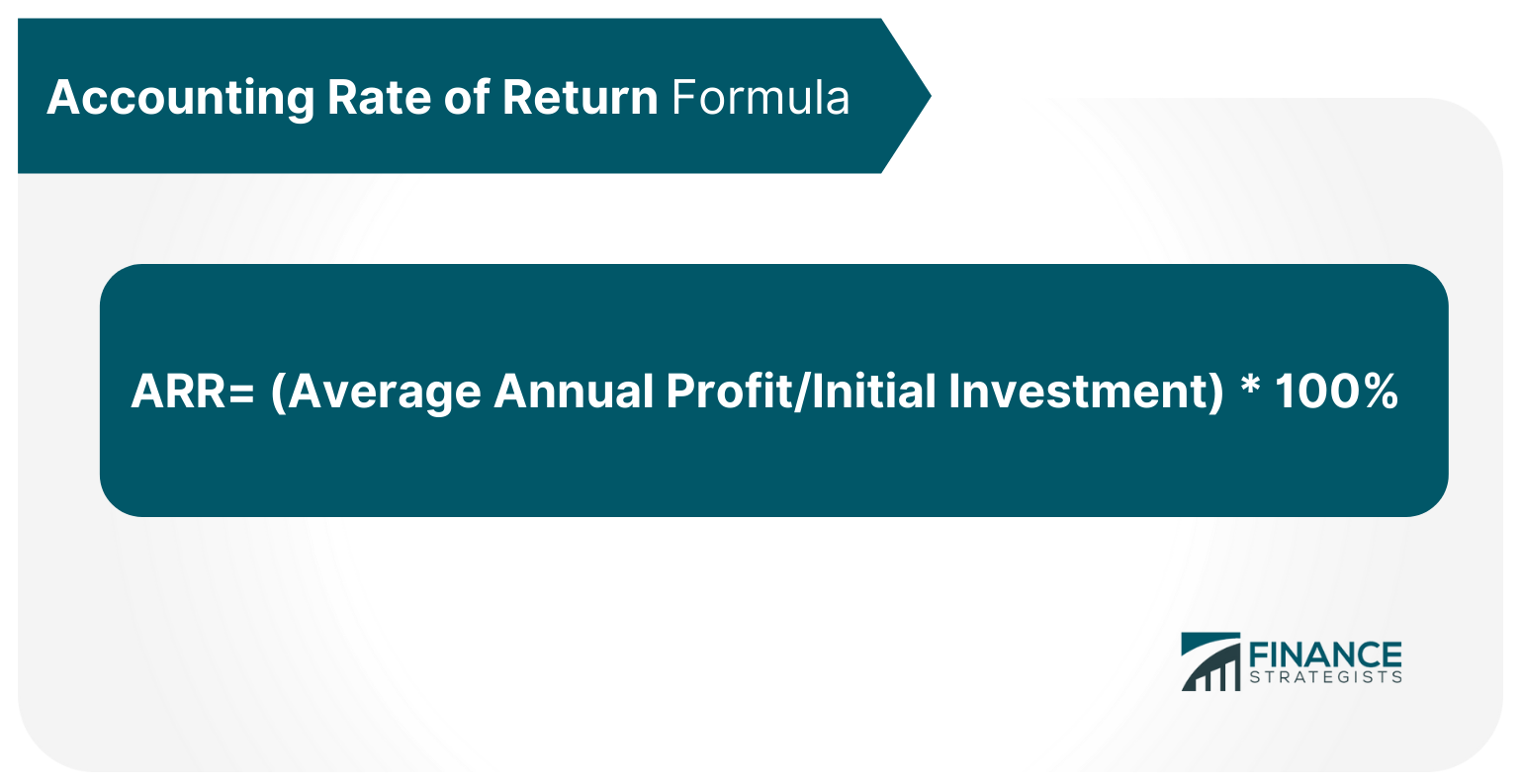

The average annual return on this investment was 75 the average of a 200 gain and 50 loss but in this two-year period the result was 1500 not. That logarithmic returns are additive. Accounting Rate of Return refers to the rate of return which is expected to be earned on the investment with respect to investments initial cost and is calculated by dividing the Average annual profit total profit over the investment period divided by number of years by the average annual profit where average annual profit is calculated by.

Those terms have formal legal definitions in. Return on investment ROI or return on costs ROC is a ratio between net income over a period and investment costs resulting from an investment of some resources at a point in time. Determine the stated interest rate.

It is estimated that the project will generate scrap value of 10500 at end of the 6th year. A high ROI means the investments gains compare favourably to its cost. The internal rate of return IRR is a metric used in capital budgeting to estimate the return of potential investments.

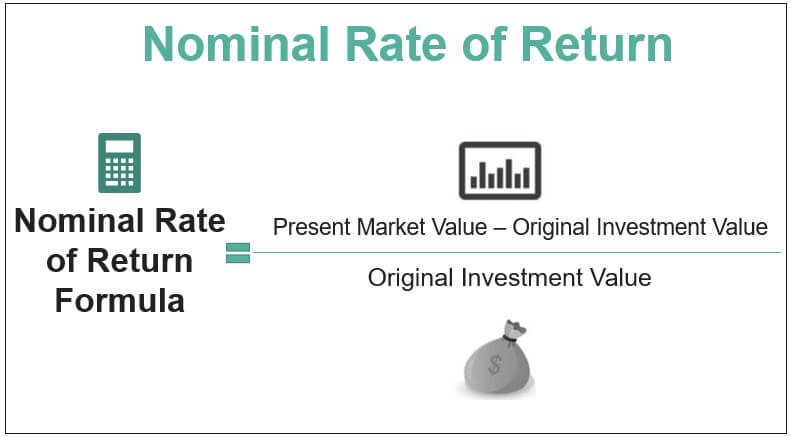

Rate of return monthly. The nominal interest rate is provided in cell H4 which is the named range rate. The term annual percentage rate of charge APR corresponding sometimes to a nominal APR and sometimes to an effective APR EAPR is the interest rate for a whole year annualized rather than just a monthly feerate as applied on a loan mortgage loan credit card etcIt is a finance charge expressed as an annual rate.

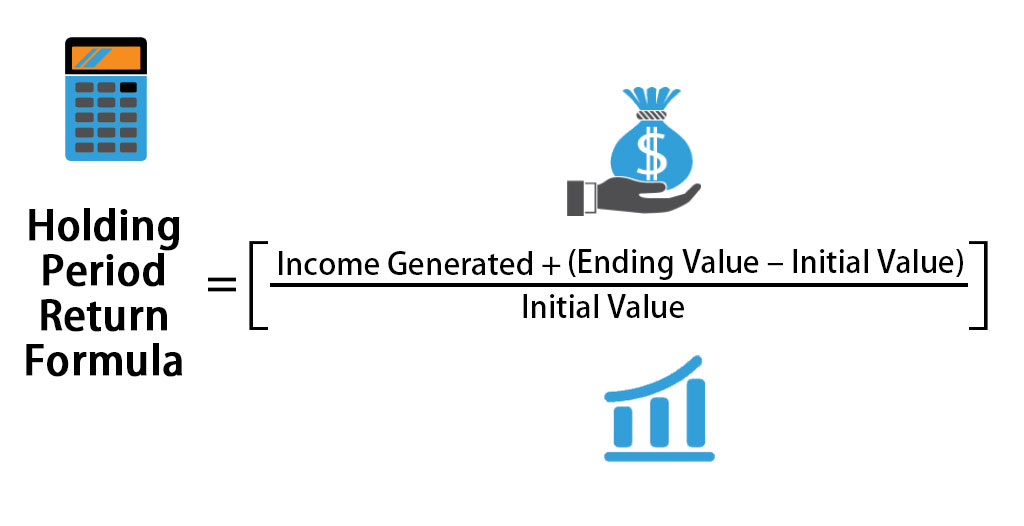

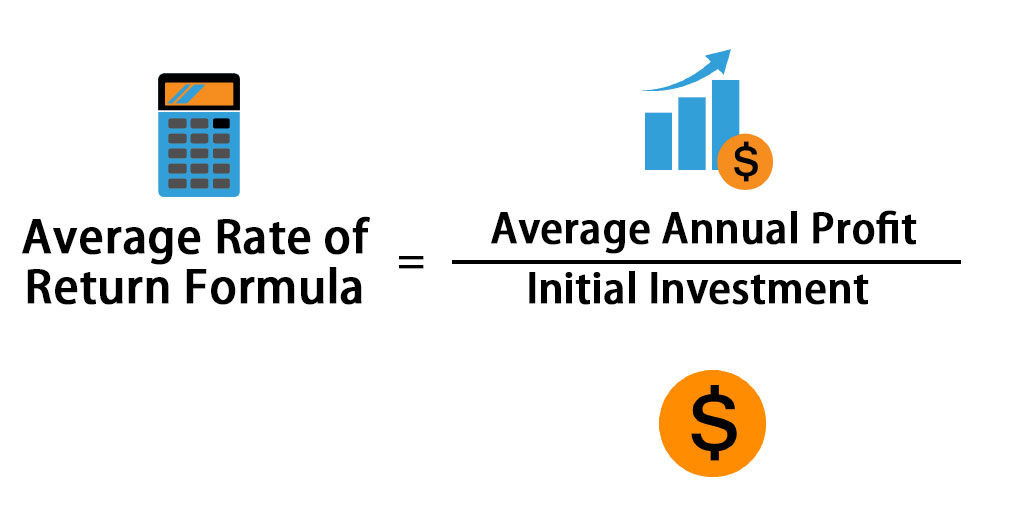

The formula for payments is found from the following argument. The formula for an average rate of return is derived by dividing the average annual net earnings after taxes or return on the investment by the original investment or the average investment during the life of the project and then expressed in terms of percentage. More Discounted Cash Flow DCF Explained With Formula and Examples.

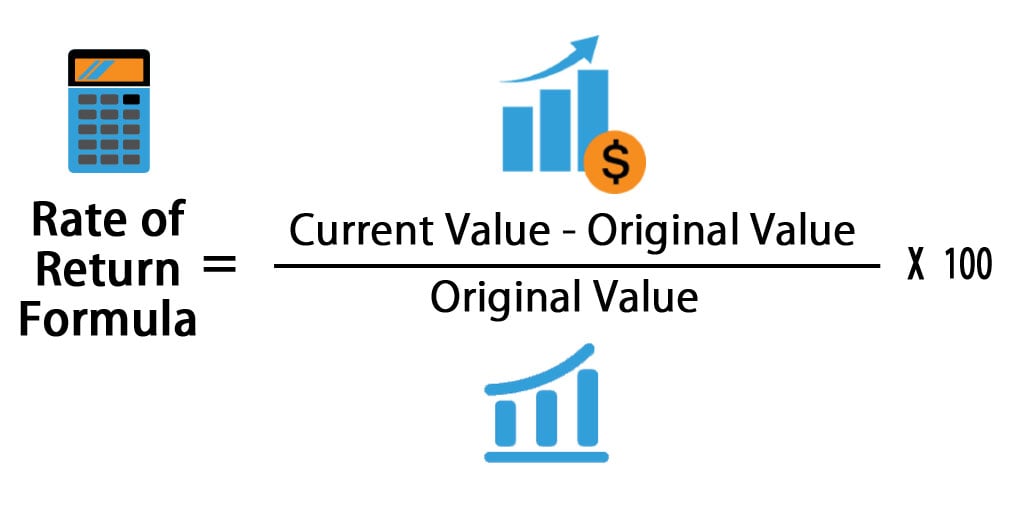

A rate of return is the gain or loss on an investment over a specified time period expressed as a percentage of the investments cost. This formula applies with an assumption of reinvestment of returns and it means that successive logarithmic returns can be summed ie. Average Rate of Return 69250 1000000.

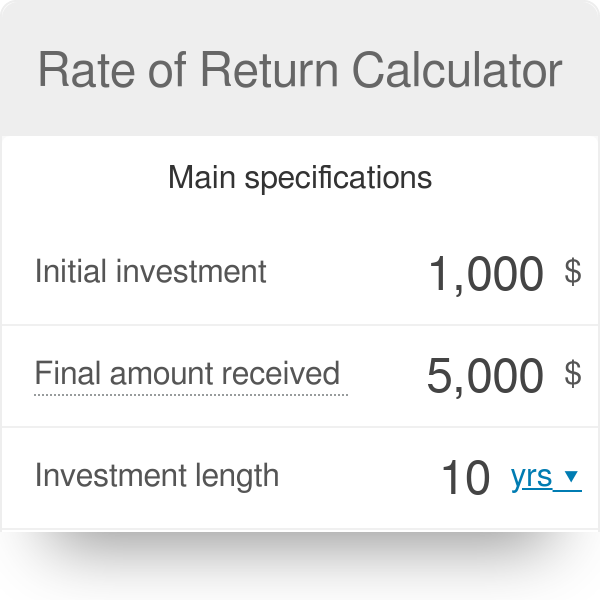

Rate of Return Formula Example 3. The market risk premium can be calculated by deducting the risk-free return from the market return. The useful life of the machine will be 10 years with no salvage value.

Formula to Calculate CAGR Compounded Annual Growth Rate CAGR Compounded Annual Growth Rate refers to the rate of return that is achieved by an investment by growing from its beginning value to its ending value based on the assumption that the profits during the tenure of the investment were reinvested at the end of each year and it is calculated by dividing the value. Average Rate of Return 6925. Accounting Rate of Return is calculated using the following formula.

Gains on investments are defined as income. Each formula used to calculate the accounting rate of return is now illustrated within the ARR calculator and each step or the calculations displayed so you can. An initial investment of 130000 is expected to generate annual cash inflow of 32000 for 6 years.

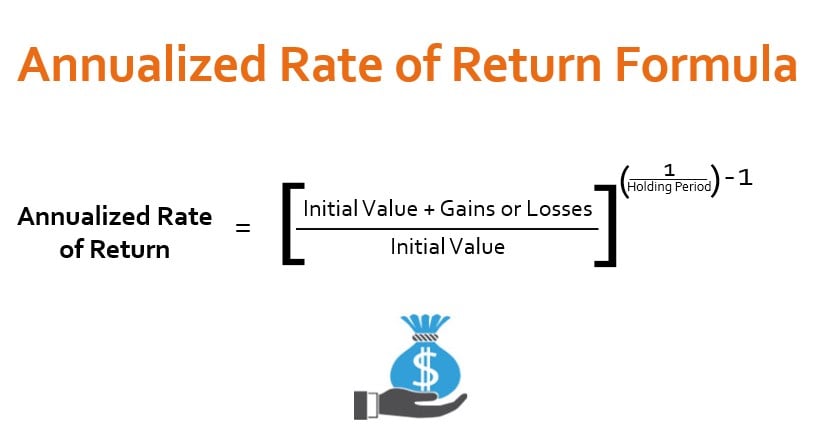

An exact formula for the monthly payment is or equivalently. What is the Accounting Rate of Return. In other words the annualized rate of return is the overall return generated by the investment over a period which is then scaled down to a 12-month or one-year period.

The minimum required rate of return is 15. Depreciation is allowed on the straight line basis. The stated interest rate also called the annual percentage rate or nominal rate is usually found in the headlines of the loan or deposit agreement.

An investor purchase 100 shares at a price of 15 per share and he received a dividend of 2 per share every year and after 5. In our example the required investment is 8475 and the net annual cost saving is 1500. Average Rate of Return Formula.

The formula for calculating average annual interest rate. In this formula any gain made is included in formula. Weekly monthly annually etc.

Formula of internal rate of return factor. We need to keep in mind that the time value of money has not to be considered here. Using average annual return does not work.

Let us see an example to understand it. The term annualized rate of return refers to the equivalent annual return that an investor earns over the investment holding period. An annual rate of return is a return over a period of one year such as January 1 through December 31 or June 3 2006 through June 2 2007 whereas an annualized.

Real Rate of Return Formula 1. The average annual growth rate AAGR is the average increase in the value of an individual investment portfolio asset or cash stream over specific interval. The installation of machine will cost 8475 and will reduce the annual labor cost by 1500.

The FV function can calculate compound interest and return the future value of an investment. As a performance measure ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several. The capitalization rate often referred to as the cap rate is a fundamental concept used in the world of commercial real estate.

Annualized Rate 1 ROI over N months 12 N where ROI Return on Investment More Interest. Exact formula for monthly payment. Compound Annual Growth Rate - CAGR.

The effective annual rate is the total accumulated interest that would be payable up to the end of one year divided by the principal sum. Accounting Rate of Return Formula The Accounting Rate of Return ARR Calculator uses several accounting formulas to provide visability of how each financial figure is calculated. So the yearly cash flow if the time value is there will not worth the same.

Average Rate of Return Average Annual Profit Initial Investment. An annualized rate of return is the return on an investment over a period other than one year such as a month or two years multiplied or divided to give a comparable one-year return. Various compounding periods in column C.

Next determine the market rate of return the annual return of an appropriate benchmark index such as the SP 500 index. The Effective Annual Rate EAR is the interest rate after factoring in compounding. Average Annual Growth Rate - AAGR.

Market risk premium. To calculate the effective interest rate using the EAR formula follow these steps. Annual rate 36 interest charged monthly 2.

Rate Of Return Calculator

Annual Return Formula How To Calculate Annual Return Example

Holding Period Return Formula Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_INV_final-Stated-Annual-Interest-Rate_2021-01-b21e3142ad46439fa021c4ce978baa68.jpg)

Stated Annual Interest Rate Definition

Return On Investment Roi Definition Equation How To Calculate It

Rate Of Return Learn How To Calculate Rates Of Return Ror

Rate Of Return Formula Calculator Excel Template

Average Rate Of Return Formula Calculator Excel Template

Accounting Rate Of Return Arr Definition Formula

Internal Rate Of Return Irr Formula And Calculator

Accounting Rate Of Return Formula Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Real Rate Of Return Definition Formula How To Calculate

Rate Of Return Formula Calculator Excel Template

How To Calculate Rate Of Return Ror Upwork

Annualized Rate Of Return Formula Calculator Example Excel Template

Nominal Rate Of Return Definition Formula Examples Calculations